[ad_1]

Economy

Ruto austerity measures spark private sector panic

Thursday February 02 2023

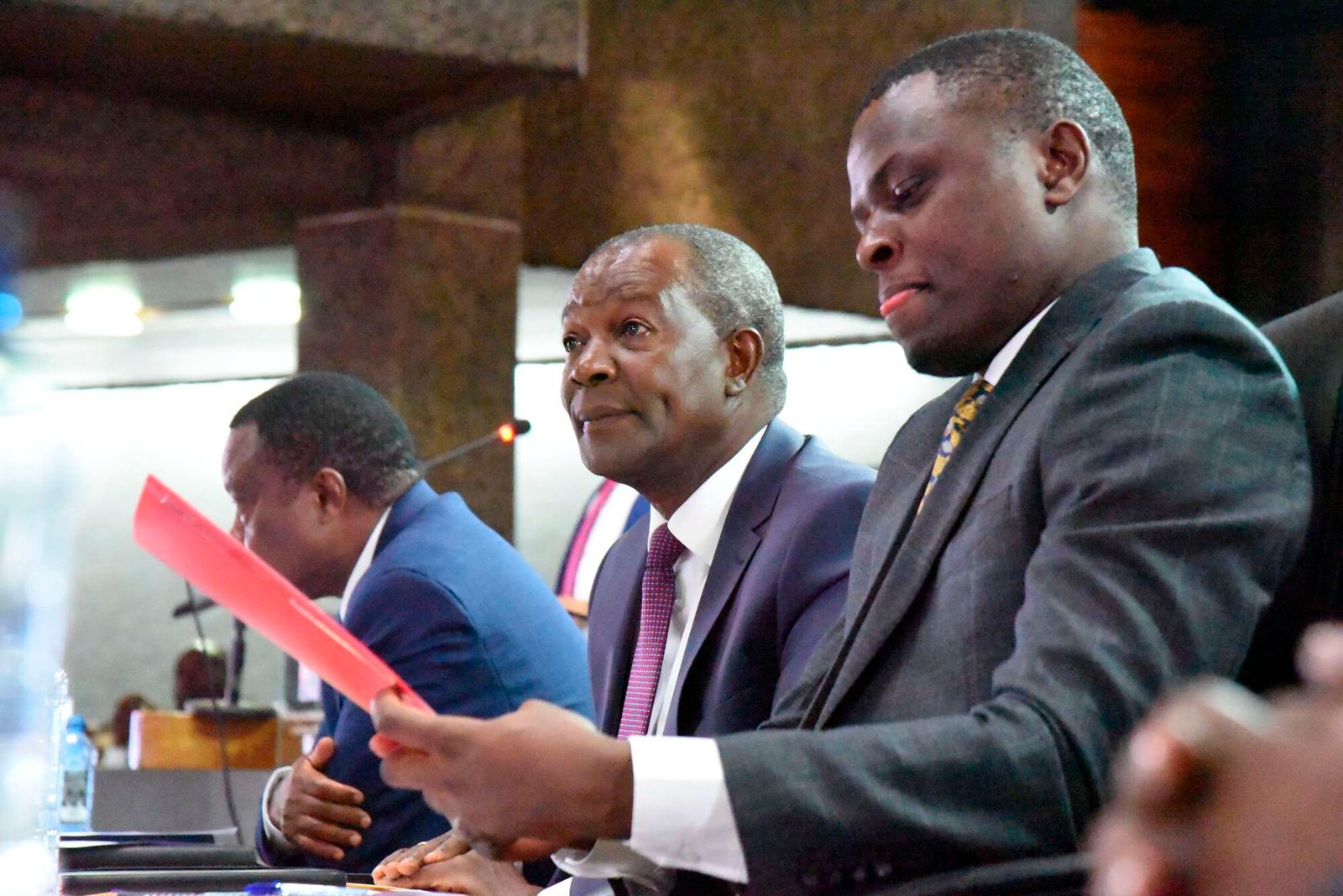

National Treasury and Economic Planning Cabinet Secretary Prof Njuguna Ndung’u with Budget and Appropriations Committee Chairperson Ndindi Nyoro on November 10, 2022. PHOTO | DIANA NGILA | NMG

Private sector players are wary of the austerity measures being implemented by the new administration, fearing that the spending cuts will hurt their economic prospects in the next 12 months.

Through the Market Perceptions Survey, done by the Central Bank of Kenya (CBK) ahead of every Monetary Policy Committee (MPC) meeting to obtain perceptions of banks and non-bank private sector firms on selected economic indicators, the respondents noted that the expenditure cuts being undertaken by the government will disrupt the prospects in the economy.

The respondents cited the planned fiscal consolidation — policies aimed at reducing government deficits and debt accumulation — by the Treasury as one of the risks to optimism this year.

“The risks to this optimism as the respondents indicated is the fiscal consolidation and indeed the issue of the agricultural sector which I think most of us now are much more susceptible to,” said CBK governor Patrick Njoroge in his MPC briefing on Wednesday.

Read: Give the private sector confidence in economy

President William Ruto wants to cut the budget deficit by reducing non-essential spending on travelling, advertising and training, in what is likely to hit hard the hospitality sector, which is just recovering from the adverse effects of the Covid-19 pandemic.

A schedule Treasury Cabinet secretary Njuguna Ndung’u published last November showed that 100 percent of the remaining balances on foreign travel, training, and motor vehicle and furniture purchase budgets as of September 30, 2022, would be cut.

The Treasury has also noted that it had effected a 75 percent cut on the remaining budgets on communication services, domestic travel, advertising and printing, hospitality, and vehicle rentals as of September 30, 2022.

Research and feasibility study budgets would also be cut by 75 per cent as the new administration aggressively undertook an expenditure rationalisation programme that is targeted at freeing up cash for other more critical projects such as healthcare, education and food security.

“Further, it has been decided that all MDAs (ministries, departments and agencies) will rationalise the development estimates by removing all new projects, rationalising projects with implementation challenges, reviewing counterpart funds and scaling down on externally funded projects with absorption between 60 to 65 percent,” said Prof Ndung’u.

The government expects to collect Sh2.04 billion while on the spending side, Prof Ndung’u told the International Monetary Fund that the government intends to contain expenditures at Sh.3.39 trillion billion “by partly offsetting existing pressures (Sh290 billion) through cuts on non-priority recurrent spending (e.g., domestic and foreign travels, training expenses, hospitality expenses)”.

The objective of the market perception survey is to obtain perceptions of banks and non-bank private sector firms on selected economic indicators including inflation, economic growth, demand for credit, growth in credit to the private sector and exchange rate.

In the projections contained in the 2023 draft Budget Policy Statement (BPS) development spending, however, has been slashed from Sh676.6 billion to Sh596.6 billion in the upcoming Supplementary Budget as the administration moves to do away with stalled projects that were started by the previous regime.

The Supplementary Budget, which will be tabled in the National Assembly when it returns from recess, will also cut a lot of non-essential spending, albeit the recurrent budget is expected to go up.

Kenya Kwanza’s fiscal consolidation is expected to rely heavily on increased tax collection with the Kenya Revenue Authority handed a Sh3 trillion target in the Financial Year 2023/24.

Read: Ruto administration to borrow Sh3.6 trillion in first term

However, the majority of the respondents, 92 percent of those in banks and 85 percent of those in non-banks, were optimistic about the economic outlook for the next 12 months.

They cited the continued resilience of the private sector, and the impact of the government’s intervention including in the agriculture and the micro, small and medium enterprises sector, which are expected to support employment and growth.

The CBK has projected the economy to have grown by 5.6 percent in 2022, compared to 7.5 per cent in 2021.

→ [email protected]

[ad_2]

Source link