[ad_1]

Economy

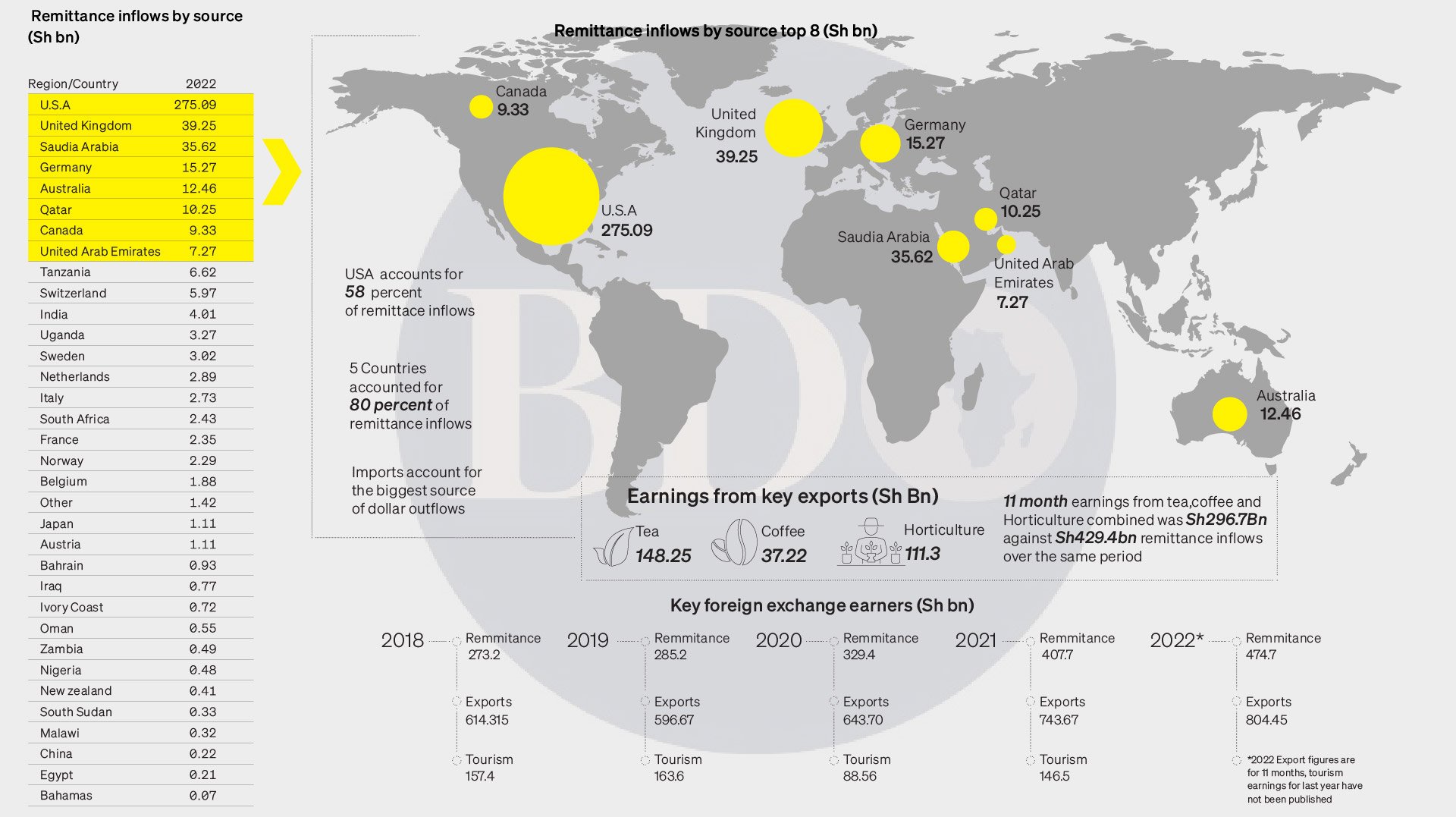

Dominance of Big Five countries puts Kenya’s remittance inflows at risk

Thursday January 26 2023

Five countries — the US, the UK, Saudi Arabia, Germany and Australia — accounted for 80 percent of the Sh474.7 billion that Kenyans wired from abroad, highlighting a huge concentration risk on its diaspora inflow sources.

Data from the Central Bank of Kenya (CBK) show that Kenyans abroad and well-wishers from those countries sent a combined Sh377.7 billion last year.

The dominance of the countries on remittances, which is the single biggest source of forex inflows ahead of tea and horticulture earnings, poses a threat should the nations face economic shocks.

Diaspora inflows last year grew at a slower rate of 16.4 percent compared to a growth of 23 percent amid sky-high inflation in the western nations, in particular the US.

Despite the high global inflation witnessed last year, diaspora inflows remained resilient and were 1.4 times higher than the combined receipts from tea, horticulture and coffee—making it a key influencer of the shilling exchange rate against the dollar.

Export receipts from the three cash crops stood at Sh296.7 billion in the 11 months to November, shows CBK data.

The global inflation was triggered by supply disruptions in the wake of Russia’s invasion of Ukraine, which made oil and food costly.

This was worsened by Covid-19 lockdowns in China that derailed supplies of key commodities across the globe.

The US, which accounts for 58 percent of Kenya’s remittance, saw its inflation hit 9.1 percent in June last year, the highest since 1981.

The high cost of living led to a hike in the Fed Fund rate — the rate at which financial institutions lend money to each other on short-term basis — to between 4.25-4.5 percent, the highest return in 15 years.

Inflation in the US has since fallen for six consecutive months to close the year at 6.5 percent. The Fed’s reaction to inflation led to currencies weakening against the dollar, including the Kenya shilling

Remittances and exports play a key role in providing hard currencies that are in turn used to pay for imports and also in debt service.

Import bills stood at Sh2.29 trillion in the eleven months to November, a faster growth compared to export receipts, and the trade deficit is poised to cross the Sh1.5 trillion barrier for last year.

→ [email protected]

[ad_2]

Source link