[ad_1]

Capital Markets

Banks, Safaricom defy court on cash transfer fees

Monday January 16 2023

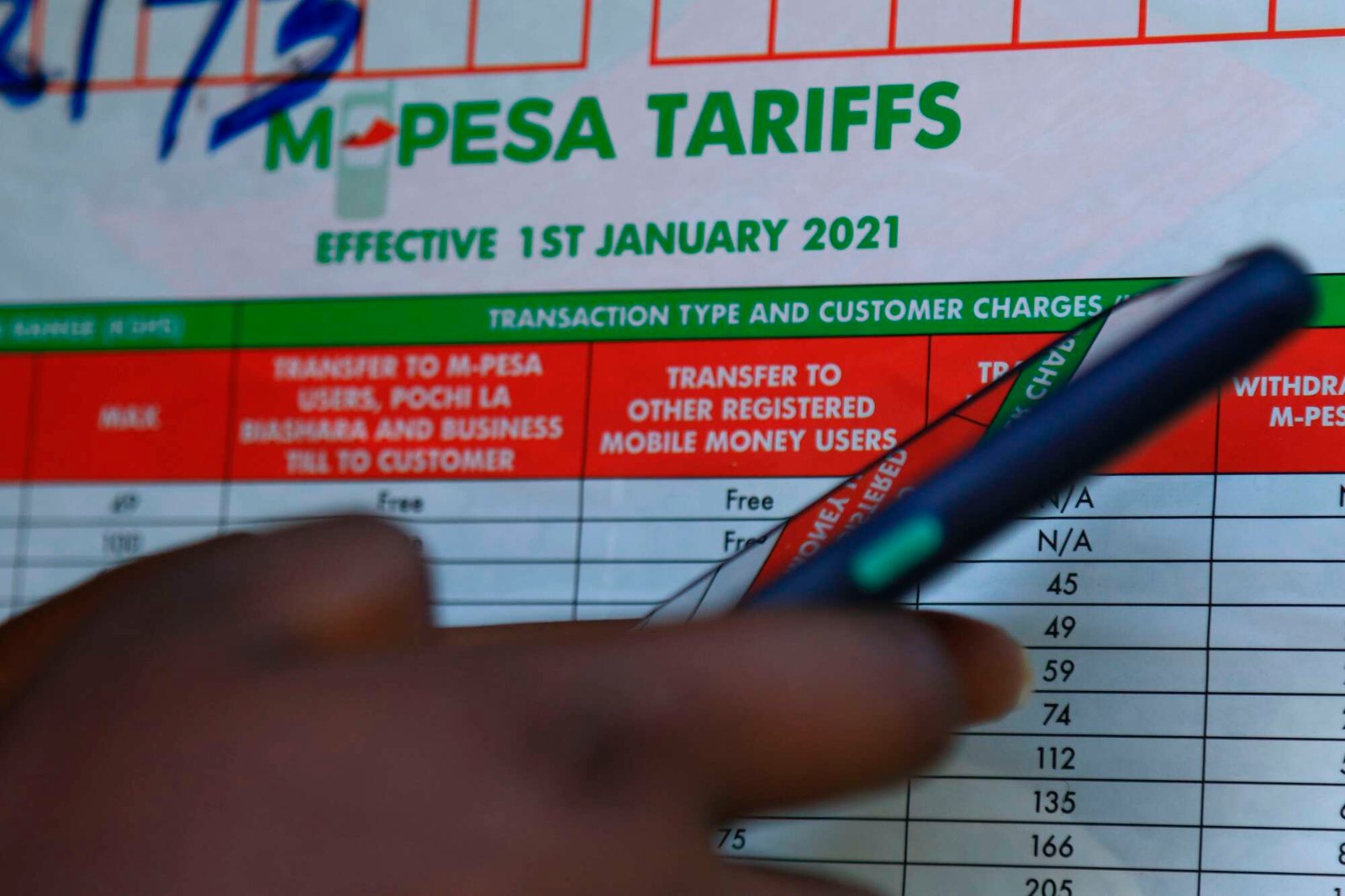

A cashless transaction via M-Pesa. FILE PHOTO | NMG

Banks and mobile money operators have proceeded to levy fees for transferring cash between their platforms despite the existence of a temporary High Court order suspending the charges.

The interim order was issued on December 19, 2022, but fees on bank-to-mobile transactions resumed on January 1 and have continued nevertheless.

The case is scheduled to come up for further directions on January 23.

A spot check on Friday showed that Safaricom (the owner of the M-Pesa mobile money platform) and banks such as KCB and Equity were still charging customers amounts exceeding Sh100.

READ: Fuliza users able to get cash from M-Pesa agents

“Pending the hearing and determination of this application and the petition, interim and conservatory orders do issue and be directed to the respondents, their agents or anyone authorised by them or acting under the instructions and/ or directions of the respondents, to stop, halt and/ or suspend the coming into effect of the reintroduction of charges for mobile money wallet and bank transactions as advanced by the intended 3rd respondent through its press release issued on the 6th December 2022,” reads the prayer granted by the court until January 23.

In the court case filed by Moses Wafula, the respondents are listed as Safaricom, the Attorney General, the Central Bank of Kenya, the Competition Authority of Kenya and the Cabinet Secretary for National Treasury and Economic Planning.

On December 6, 2022, the Central Bank of Kenya granted banks the green light to reinstate charges effective January 1, 2023.

Mr Wafula claims that the charges should not be passed to consumers.

Asking the court to put brakes on the charges, he said that the M-Pesa Paybill charges are illegal, more funds from the members of the public will have been lost and it may be difficult to ask the banks to refund the same.

He contends that his rights and those of other members of the public have been violated, infringed and continue to be threatened by the giant telecommunication firm and the Government of Kenya in view of the directive issued by CBK.

He argues that it is in contravention of the law for the banks to continue riding on the M-Pesa Paybill infrastructure and making money from members of the public.

According to him, charges incurred in M-Pesa Paybill services are to be paid for by Safaricom’s primary clients such as banks and not the consumers.

Mr Wafula says M-Pesa Paybill services being an outsourced service, “Safaricom has no authority to charge members of the public for a service offered to its contracting service recipients including banks”.

“The petition pending determination illustrates that the engagement between Safaricom and its M-Pesa Paybill clients (such as Banks, Government agencies, Kenya power, DStv, Betting companies, Mobile money companies, and other institutions) is a bipartite business engagement between Safaricom as the M-Pesa Paybill service provider and their M-Pesa Paybill primary clients being the service recipients.

READ: High Court suspends bank to mobile money charges

The charges were waived on March 16, 2020, as part of the emergency measures to facilitate the use of mobile money at the height of the Covid-19 pandemic. Most Kenyans and businesses shifted to digital payments.

→[email protected]

[ad_2]

Source link